Renters Insurance in and around Tampa

Renters of Tampa, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your TV to your microwave. Overwhelmed by the many options? That's okay! Doug Johnson is here to help you identify coverage needs and help find insurance that is reliable and a good fit today.

Renters of Tampa, State Farm can cover you

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Doug Johnson can help you with a plan for when the unpredictable, like a fire or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Tampa renters, are you ready to discover the benefits of a State Farm renters policy? Call or email State Farm Agent Doug Johnson today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

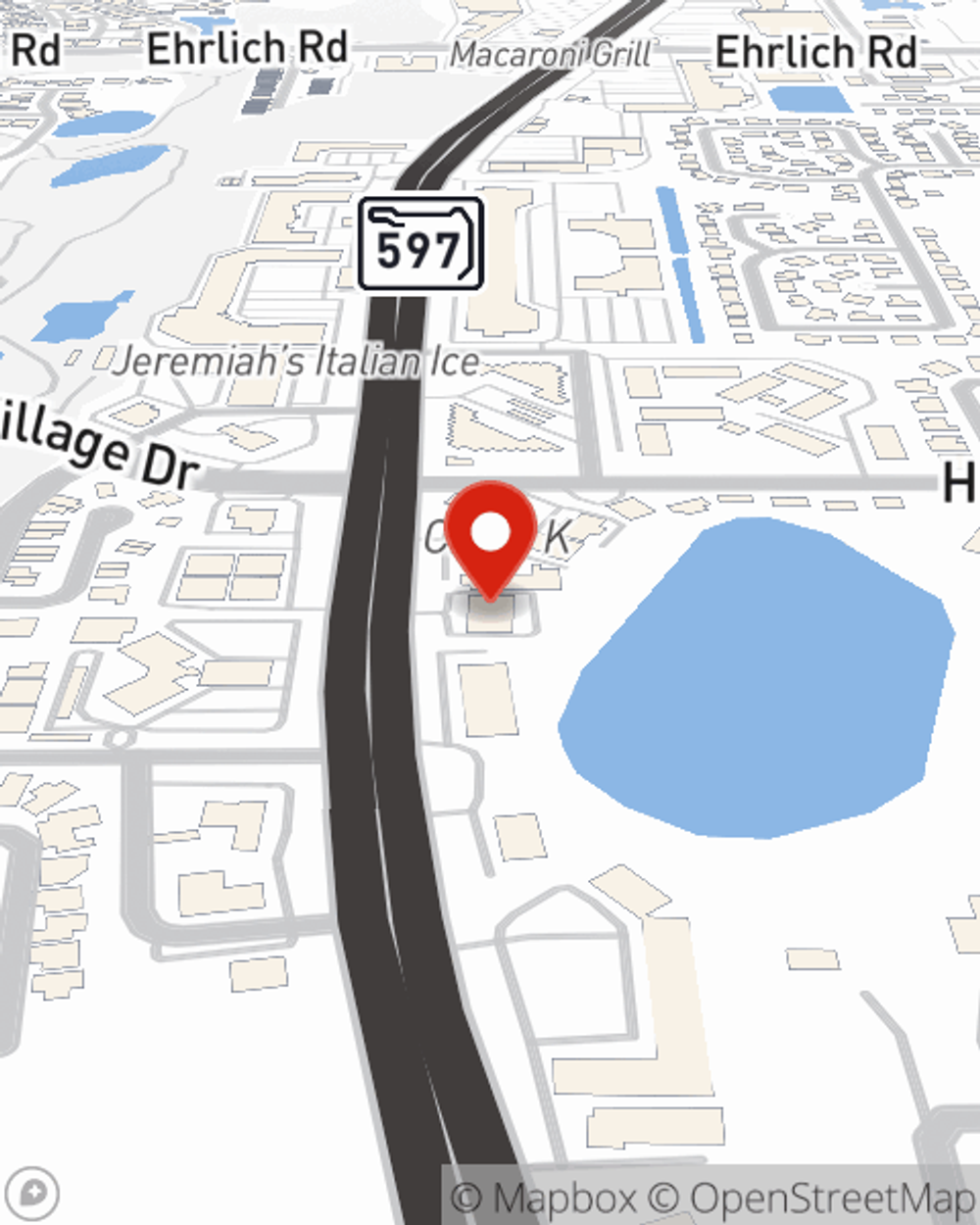

Call Doug at (813) 264-1525 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Doug Johnson

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.